Fidelity Bitcoin Ethereum Etf Outflow Insights And Trends

With fidelity bitcoin ethereum etf outflow at the forefront, the landscape of cryptocurrency investment is shifting, creating both opportunities and challenges for investors. As Fidelity continues to play a pivotal role in this burgeoning market, understanding the dynamics of ETF outflows is essential for anyone looking to navigate these waters effectively.

ETFs, or exchange-traded funds, serve as a bridge for investors seeking exposure to cryptocurrencies like Bitcoin and Ethereum without directly owning them. Fidelity’s offerings in this arena highlight its commitment to harnessing the potential of digital currencies, yet recent trends in outflows signal a need for deeper analysis.

Introduction to Fidelity Bitcoin and Ethereum ETFs

Fidelity has emerged as a key player in the cryptocurrency investment landscape, particularly through its offerings of Bitcoin and Ethereum Exchange-Traded Funds (ETFs). ETFs are investment funds that are traded on stock exchanges, similar to individual stocks. They allow investors to gain exposure to various assets, including cryptocurrencies, without needing to directly purchase the underlying assets. Fidelity’s role in this sector signifies a growing acceptance of digital currencies as a viable investment option.Bitcoin and Ethereum stand as the leading cryptocurrencies, each with unique characteristics and market positions.

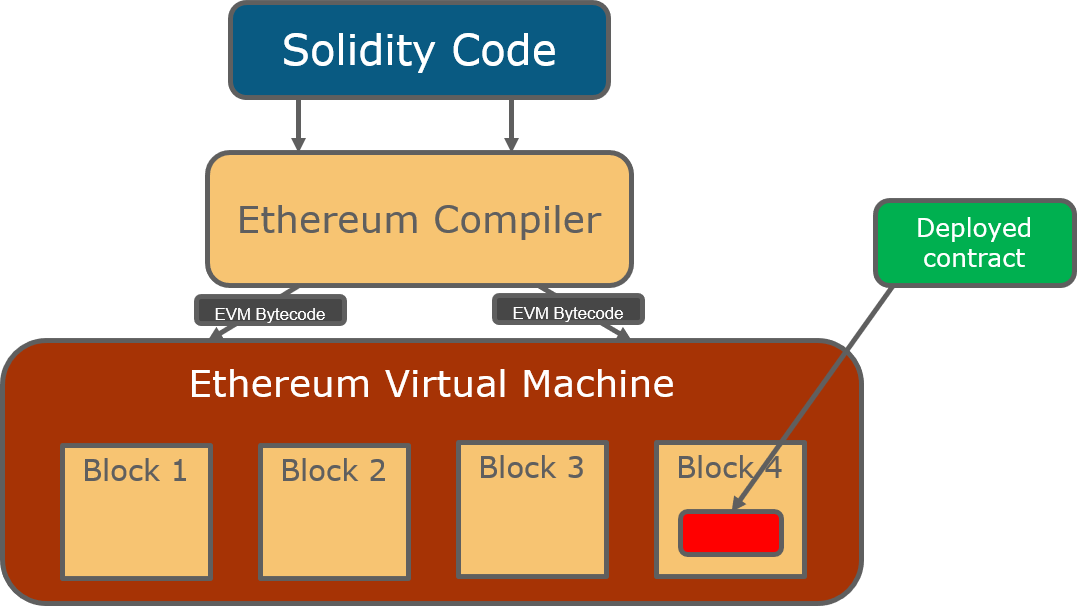

Bitcoin, often dubbed ‘digital gold’, serves as a store of value and a medium of exchange, while Ethereum expands the use of blockchain technology through smart contracts and decentralized applications. Together, they form the backbone of the burgeoning cryptocurrency market.

Understanding ETF Outflows

ETF outflows refer to the movement of capital out of an ETF, indicating that investors are selling their shares. This can have significant implications for the market, as large outflows can suggest declining investor confidence and potentially lead to price drops in the underlying assets. For Fidelity’s Bitcoin and Ethereum ETFs, outflows can be influenced by various factors, including market volatility, macroeconomic conditions, and changes in investor sentiment.Recent trends show that both the Fidelity Bitcoin and Ethereum ETFs have experienced notable outflows.

For instance, a report from the past quarter indicated a combined outflow of over $200 million from these ETFs. Such statistics not only reflect investor behavior but also underscore the impact of external economic factors on cryptocurrency investments.

Market Reactions to Outflows

Significant ETF outflows can trigger various reactions in the market, often leading to increased volatility. When Fidelity experiences large outflows, it can instigate a wave of selling in the broader cryptocurrency market, as investors react to perceived weakness. During periods of high outflows, investor sentiment often shifts towards caution, with many opting to liquidate their positions rather than risk further losses.To illustrate the effects of historical ETF outflows on market dynamics, the following table summarizes notable outflow events alongside subsequent market changes:

| Date | Event Description | Market Reaction |

|---|---|---|

| January 2023 | $100 million outflow from Bitcoin ETF | Bitcoin price dropped 10% over the next week |

| March 2023 | $150 million outflow from Ethereum ETF | Ethereum experienced a 12% decline in value |

Comparison of Fidelity ETFs with Other Cryptocurrency ETFs

When comparing Fidelity’s Bitcoin and Ethereum ETFs to those offered by competitors, several performance metrics come into play. Key aspects to consider include returns, fees, and inflow/outflow trends, which can significantly impact investor choices.

Performance Metrics

Fidelity ETFs have historically shown competitive returns, though they may vary during periods of market volatility.

Fees associated with Fidelity’s ETFs tend to be lower than many competing options, making them more attractive for cost-sensitive investors.

Additionally, unique features that differentiate Fidelity ETFs from others include:

- Strong institutional backing and reputation.

- Comprehensive research and educational resources provided to investors.

- Innovative investment strategies aimed at maximizing returns in varying market conditions.

Future Implications of Current Outflows

The ongoing outflows from Fidelity’s cryptocurrency ETFs could pose long-term implications for its strategic approach to the digital asset market. If these trends persist, Fidelity may need to reassess its offerings, potentially leading to the introduction of new products or a shift in focus towards alternative investment strategies.Investor behavior may also evolve in response to these outflows, with many becoming more cautious and looking for diversification to mitigate risks.

Additionally, continued regulatory scrutiny in the cryptocurrency space could further influence ETF outflows, as compliance requirements may change the landscape for both issuers and investors.

Strategies for Investors Amidst Outflows

Navigating outflows in cryptocurrency ETFs requires a well-thought-out strategy. Investors should consider the following guidelines to manage their investments effectively during turbulent times:

Risk Management Techniques

Diversification across different asset classes to spread risk.

Setting stop-loss orders to limit potential losses.

Regularly reviewing and adjusting investment portfolios based on market conditions.

It’s essential for investors to remain informed and adaptable, particularly in a market as volatile as cryptocurrency. By employing these strategies, they can better position themselves to weather potential downturns.

Innovations in Cryptocurrency ETFs

The cryptocurrency ETF landscape is rapidly evolving, with recent innovations promising to reshape Fidelity’s offerings. New products may include actively managed ETFs or those that incorporate advanced technologies like artificial intelligence to optimize investment strategies.As the market responds to ongoing outflows, there is potential for the emergence of new ETF structures that cater to investors seeking more dynamic solutions. Examples of innovative strategies could include thematic ETFs that target specific sectors within the cryptocurrency space or those that integrate ESG (Environmental, Social, and Governance) criteria.These developments signal a transformative period for cryptocurrency ETFs, highlighting the need for investors to remain vigilant and informed about the latest trends and opportunities in this exciting market.

Last Word

In conclusion, the fidelity bitcoin ethereum etf outflow scenario encapsulates a broader narrative of investor sentiment and market evolution. As trends continue to unfold, staying informed will be key for investors aiming to optimize their strategies amidst the fluctuations in ETF performance.

Questions Often Asked

What are ETFs?

ETFs are investment funds that are traded on stock exchanges, much like stocks, allowing investors to buy shares in a collection of assets.

Why are ETF outflows significant?

ETF outflows indicate a decline in investor confidence and can lead to price volatility in the underlying assets.

How can investors manage risks during outflows?

Investors can manage risks by diversifying their portfolios and employing strategies such as stop-loss orders.

What factors contribute to ETF outflows?

Factors can include market sentiment, regulatory changes, and performance metrics that lead investors to withdraw their capital.

What future trends might impact ETF outflows?

Future trends may include regulatory developments, technological advancements, and shifts in investor behavior towards cryptocurrencies.