Bitcoin And Ethereum Etf Inflows Trends And Impacts

Kicking off with bitcoin and ethereum etf inflows, the recent surge in interest surrounding these financial instruments marks a significant evolution in the investment landscape. As both cryptocurrencies gain traction among institutional and retail investors alike, understanding their ETF counterparts becomes crucial for those navigating the market.

Exchange-Traded Funds (ETFs) have opened new avenues for investors, allowing them to gain exposure to Bitcoin and Ethereum without directly owning the assets. With a rich history and distinct characteristics, these funds have been evolving alongside the cryptocurrencies they represent, making it essential to explore the latest trends, market impacts, regulatory considerations, and investor behaviors associated with their inflows.

Overview of Bitcoin and Ethereum ETFs

Exchange-Traded Funds (ETFs) have emerged as a popular investment vehicle, allowing investors to gain exposure to various assets without having to directly purchase them. In the cryptocurrency realm, Bitcoin and Ethereum ETFs enable investors to participate in the dynamics of these leading cryptocurrencies through a regulated platform. This section explores the origins of Bitcoin and Ethereum ETFs, alongside their distinct characteristics.

Concept of ETFs and Their Relation to Bitcoin and Ethereum

ETFs are investment funds that trade on stock exchanges, similar to stocks. They hold assets such as stocks, commodities, or cryptocurrencies and generally operate with a goal of mirroring the performance of a specific index. Bitcoin and Ethereum ETFs specifically track the price movements of Bitcoin and Ethereum, allowing investors to buy shares of the fund instead of the underlying cryptocurrencies directly.

This structure offers several advantages, including ease of trading, potential tax benefits, and increased liquidity.

Historical Context on the Introduction of Bitcoin and Ethereum ETFs

The first Bitcoin ETF was proposed in 2013, but it took several years for regulatory bodies to approve such products. In 2021, the first Bitcoin futures ETF was launched in the United States, marking a significant milestone. Ethereum ETFs followed, with Canada leading the charge by approving its first Ethereum ETF shortly after Bitcoin's approval. This gradual introduction has paved the way for broader acceptance and investment in these cryptocurrencies via ETFs.

Differences Between Bitcoin and Ethereum ETFs

While both Bitcoin and Ethereum ETFs serve similar purposes, they have notable differences:

- Underlying Asset: Bitcoin ETFs focus solely on Bitcoin, while Ethereum ETFs invest in Ethereum.

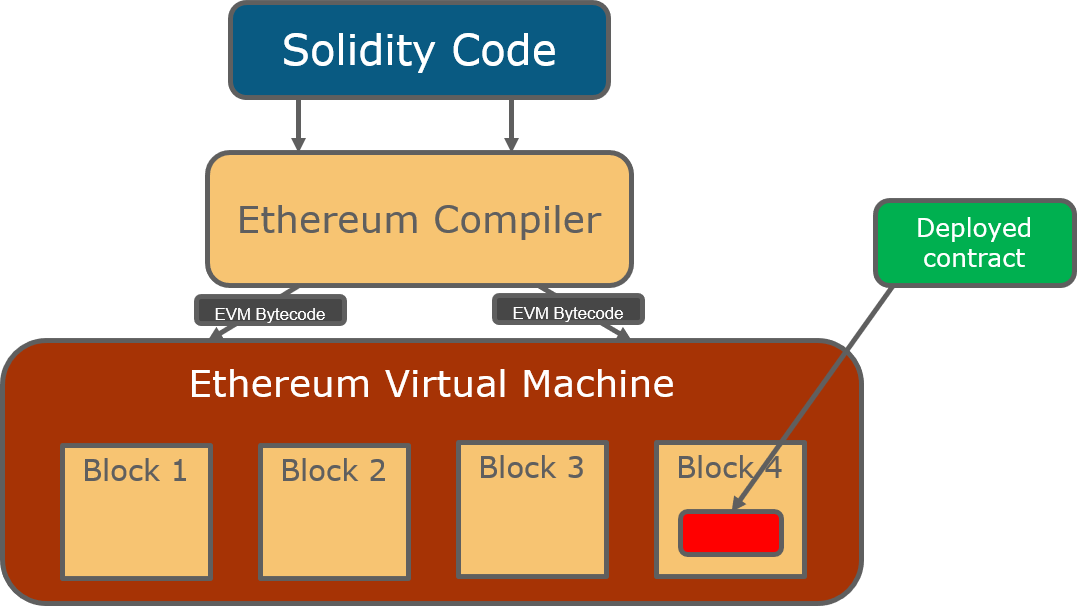

- Market Behavior: Bitcoin often exhibits a more straightforward price trajectory, whereas Ethereum's price can be influenced by its utility in smart contracts and decentralized applications.

- Demand Drivers: Bitcoin is primarily viewed as digital gold, while Ethereum's value is driven by its network's capabilities and innovations.

Current Trends in ETF Inflows

The recent months have shown significant trends concerning the inflows into Bitcoin and Ethereum ETFs. This section highlights the increase in investments and the driving forces behind these trends.

Recent Trends in Bitcoin and Ethereum ETF Inflows

The inflows into Bitcoin and Ethereum ETFs have surged, reflecting growing institutional interest. Bitcoin ETFs have seen particularly robust inflows, often attributed to the increasing acceptance of Bitcoin as a legitimate asset class. Ethereum ETFs are also gaining traction, although at a slightly slower pace.

Factors Driving Inflows Toward Bitcoin and Ethereum ETFs

Several factors are influencing the increased inflows into these ETFs:

- Institutional Adoption: Major companies and institutional investors are increasingly allocating funds to cryptocurrencies, viewing ETFs as a safer entry point.

- Market Volatility: Given the volatile nature of cryptocurrencies, ETFs provide a more stable investment route.

- Regulatory Clarity: Improved regulation around cryptocurrencies and ETFs has fostered a more secure investment environment.

Growth Rate of Inflows for Both Cryptocurrencies

Recent data illustrates that Bitcoin ETF inflows have outpaced those of Ethereum. According to reports, Bitcoin ETFs recorded over $1 billion in inflows in a single month, while Ethereum ETFs reached notable milestones, albeit with less volume. This dynamic showcases the market's preference for Bitcoin in the current context.

Impact of ETF Inflows on Market Prices

ETF inflows have a significant influence on the market prices of Bitcoin and Ethereum. This section discusses how these inflows correlate with price movements and institutional investments.

Influence of ETF Inflows on Market Prices

The relationship between ETF inflows and price movements is strong. As more capital flows into ETFs, demand for the underlying cryptocurrencies increases, often leading to price appreciation. Historical data suggests that substantial inflow periods are typically followed by notable price surges.

Price Movements During Substantial Inflow Periods

Analysis of price trends reveals that Bitcoin often experiences sharper price increases during inflow surges compared to Ethereum. For example, during a significant inflow episode last year, Bitcoin's price rose by over 30%, while Ethereum followed suit with a more modest increase of around 15%.

Correlation Between Institutional Investments and ETF Inflows

The correlation between institutional investments and ETF inflows is evident. As institutions enter the market, they often favor ETFs for their regulatory framework and ease of access, which in turn drives further inflows. This cycle reinforces the legitimacy of cryptocurrencies as viable investment options.

Regulatory Considerations

The regulatory landscape surrounding Bitcoin and Ethereum ETFs plays a crucial role in their development and market behavior. This section delves into recent changes and their implications.

Regulatory Landscape Surrounding Bitcoin and Ethereum ETFs

Regulatory bodies, particularly in the U.S., have been gradually refining their stance on cryptocurrency ETFs. The approval of Bitcoin futures ETFs marked a pivotal change, and there is growing anticipation for spot Bitcoin and Ethereum ETF approvals.

Recent Regulatory Changes Affecting ETF Approvals and Operations

Recent shifts in regulations, including clearer guidelines from the SEC, have prompted a wave of ETF applications. These changes are expected to contribute to a more favorable environment for the approval of additional ETFs, enhancing market confidence.

Implications of Regulation on ETF Inflows

Stricter regulations can have mixed implications on ETF inflows. While they can enhance investor confidence and lead to increased inflows, overly stringent regulations may deter potential investors. Therefore, finding a balance is essential for fostering a healthy market.

Investor Sentiment and Behavior

The launch of Bitcoin and Ethereum ETFs has notably shifted investor sentiment and behavior. This section analyzes these trends and their implications.

Investor Sentiment Towards Bitcoin and Ethereum ETFs

Investor sentiment has become increasingly positive towards Bitcoin and Ethereum ETFs. Many perceive ETFs as a less risky way to gain exposure to cryptocurrencies, leading to a growing acceptance among traditional investors.

Shifts in Investor Behavior Following ETF Introductions

The introduction of ETFs has changed how investors interact with cryptocurrencies. There is a notable increase in the diversification of portfolios, with investors spreading their investments across both Bitcoin and Ethereum ETFs.

Demographics of ETF Investors in Bitcoin versus Ethereum

The demographics of ETF investors reveal interesting insights:

| Demographic Category | Bitcoin ETF Investors | Ethereum ETF Investors |

|---|---|---|

| Age Group | 30-45 | 25-40 |

| Investment Experience | Experienced | Intermediate |

| Risk Appetite | Moderate | High |

Future Prospects for Bitcoin and Ethereum ETFs

The landscape for Bitcoin and Ethereum ETFs is evolving, with promising prospects for future growth. This section discusses anticipated trends and potential impacts of emerging technologies.

Potential Future Trends in ETF Inflows

Forecasts suggest continued growth in ETF inflows for both Bitcoin and Ethereum. Market analysts predict that as more institutional investors enter the space, inflows could increase significantly, especially if additional ETFs gain approval.

Emerging Technologies Affecting ETF Structure and Performance

Technological advancements, such as blockchain innovations and enhanced trading platforms, may improve ETF performance and operational efficiency. These developments could lead to better tracking of underlying asset performance and reduced costs.

Predictions Regarding Market Developments and ETF Adoption

Market experts anticipate that the growing acceptance of cryptocurrencies in mainstream finance will further drive ETF adoption. As more traditional finance institutions embrace digital assets, the reliance on ETFs as a primary investment vehicle is likely to increase.

Ultimate Conclusion

In summary, the trajectory of bitcoin and ethereum etf inflows reveals much about the underlying market dynamics and investor sentiment. As these financial products continue to develop, their impacts on market prices and investor behavior will only grow more pronounced. Staying informed about regulatory changes and emerging trends will be key for anyone looking to capitalize on the opportunities presented by these ETFs.

Questions Often Asked

What are Bitcoin and Ethereum ETFs?

Bitcoin and Ethereum ETFs are investment funds that track the price of the respective cryptocurrencies, allowing investors to buy shares of the fund instead of the cryptocurrencies directly.

How do ETF inflows affect cryptocurrency prices?

ETF inflows can drive up the demand for the underlying cryptocurrencies, often leading to price increases as more institutional and retail investors enter the market.

What factors influence the inflows to Bitcoin and Ethereum ETFs?

Factors include market sentiment, regulatory developments, economic conditions, and the overall performance of the crypto market.

Are there any risks associated with investing in cryptocurrency ETFs?

Yes, risks include market volatility, regulatory changes, and potential liquidity issues that may affect fund performance.

How have Bitcoin and Ethereum ETF inflows changed over time?

There has been a noticeable increase in inflows as more investors seek exposure to these assets, particularly as institutional interest has grown.