Bitcoin Ethereum Solana Chart Insights For Investors

Exploring the bitcoin ethereum solana chart reveals a fascinating interplay of technology and market dynamics that shapes the future of cryptocurrency investment. Understanding the distinctions between these three leading digital currencies—Bitcoin, Ethereum, and Solana—offers invaluable insights for traders and enthusiasts alike.

From the underlying technologies that drive these assets to the significant price movements shaped by market sentiment, this overview will guide you through the essential aspects of Bitcoin, Ethereum, and Solana, setting the stage for informed trading decisions.

Overview of Bitcoin, Ethereum, and Solana

Cryptocurrencies have revolutionized the financial landscape, with Bitcoin, Ethereum, and Solana leading the charge. Each of these digital assets serves distinct purposes and employs different technologies, making them unique in the crypto market. Understanding their fundamental differences helps investors and enthusiasts navigate the complexities of the blockchain ecosystem.Bitcoin, launched in 2009, is the first cryptocurrency and is often referred to as digital gold due to its limited supply of 21 million coins.

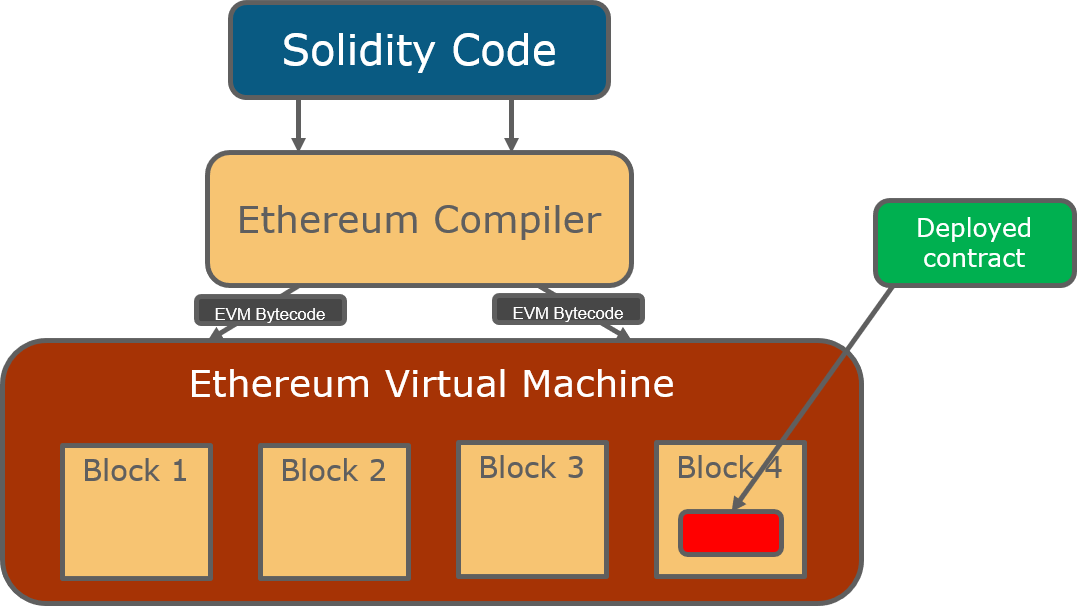

Its primary role is to serve as a store of value and a medium of exchange. On the other hand, Ethereum, which debuted in 2015, introduced smart contracts, allowing developers to create decentralized applications (dApps) on its platform. Solana, emerging in 2020, seeks to enhance scalability and speed, boasting a high throughput that caters to decentralized finance (DeFi) and non-fungible tokens (NFTs) applications.

Technological Foundations and Historical Price Movements

The technology underpinning these cryptocurrencies significantly influences their performance and adoption. Bitcoin relies on a proof-of-work consensus mechanism, which, while secure, has been criticized for its energy consumption. Ethereum is transitioning to a proof-of-stake model with Ethereum 2.0, aimed at improving scalability and reducing environmental impact. Solana employs a unique proof-of-history mechanism, allowing for faster transaction speeds and lower fees.In terms of historical price movements, Bitcoin has seen dramatic fluctuations, peaking near $64,000 in April 2021 before experiencing significant corrections.

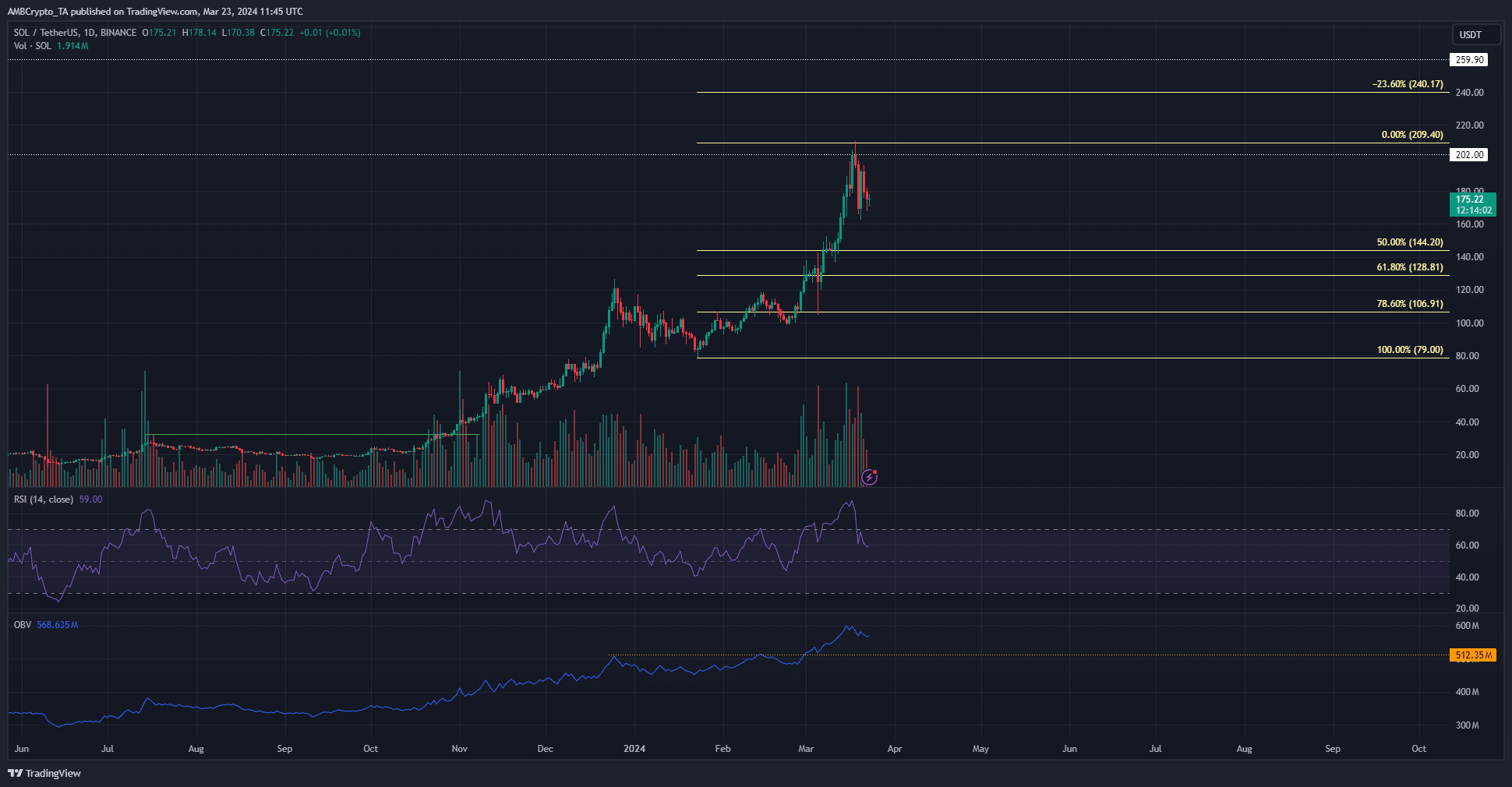

Ethereum, similarly, reached an all-time high of over $4,800 in November 2021, driven by the surge in DeFi and NFT markets. Solana’s rapid ascension is noteworthy; it reached a high of around $260 within a year of its launch, showcasing strong investor interest and adoption.

Comparative Chart Analysis

Comparative analysis offers insights into the performance of Bitcoin, Ethereum, and Solana over the past year. The following table highlights their price performance, market capitalization, and trading volumes during significant market events.

| Cryptocurrency | Price (Last Year Peak) | Market Cap (Approx.) | Trading Volume (24h) |

|---|---|---|---|

| Bitcoin | $64,000 | $1 trillion | $30 billion |

| Ethereum | $4,800 | $550 billion | $20 billion |

| Solana | $260 | $80 billion | $2 billion |

Significant price changes often correlate with events such as regulatory announcements, technological upgrades, and market sentiment shifts. For instance, Bitcoin’s price surged in anticipation of institutional adoption, while Ethereum’s growth during DeFi’s boom illustrates the influence of application development on price.

Technical Indicators for Charting

Understanding technical indicators is crucial for analyzing cryptocurrency charts and making informed trading decisions. Key indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

- Moving Averages: The 50-day and 200-day moving averages are commonly used to identify trends. A crossover of the 50-day moving average above the 200-day can signal a bullish trend for Bitcoin, Ethereum, and Solana.

- Relative Strength Index (RSI): This momentum oscillator ranges from 0 to 100 and indicates whether an asset is overbought or oversold. A reading above 70 suggests overbought conditions, while below 30 indicates oversold conditions, applicable to all three cryptocurrencies.

- Bollinger Bands: These bands help assess volatility. Price approaching the upper band may indicate overbought conditions, whereas touching the lower band may suggest overselling.

Market Sentiment and Its Impact on Price Charts

Market sentiment plays a pivotal role in influencing cryptocurrency prices. Investor emotions, driven by news events, social media trends, and market analyses, can lead to significant price swings.For instance, positive news regarding Bitcoin’s acceptance by a major corporation can lead to a surge in prices, while negative news about regulatory crackdowns often results in sharp declines. Social media platforms amplify these reactions, with trends on Twitter or Reddit sometimes dictating short-term price movements.

The meme-driven rally surrounding Dogecoin in 2021 exemplifies this phenomenon.

Future Predictions Based on Current Trends

Future price predictions for Bitcoin, Ethereum, and Solana rely on current trends and emerging technologies. Analysts suggest potential price scenarios based on historical data and market behavior.

- Bitcoin: Predictions for Bitcoin range widely, with some analysts forecasting a return to previous highs in response to increasing institutional adoption and inflation hedging.

- Ethereum: As Ethereum 2.0 progresses, analysts anticipate substantial growth, potentially pushing prices above $10,000 influenced by the growth in dApps and NFTs.

- Solana: With its focus on speed and scalability, Solana may see continued growth, especially if it successfully captures more of the DeFi and NFT markets, possibly hitting new price records.

Risk Management Strategies

Effective risk management is essential in cryptocurrency trading. Here are several strategies to consider for Bitcoin, Ethereum, and Solana:

- Setting Stop-Loss Orders: Traders should use stop-loss orders to limit potential losses. For instance, setting a stop-loss at 10% below the entry price can protect capital against adverse movements.

- Diversification: Investors should diversify their portfolios across different cryptocurrencies to mitigate risk. Allocating funds to Bitcoin, Ethereum, and Solana can help balance exposure.

- Position Sizing: Determining the appropriate amount to invest in each trade can reduce overall risk. This approach helps prevent significant losses from any single investment.

Community and Development Support

The communities surrounding Bitcoin, Ethereum, and Solana greatly influence their development and longevity. Each cryptocurrency has a dedicated group of developers and users who contribute to its growth.

| Cryptocurrency | Community Support | Key Contributors |

|---|---|---|

| Bitcoin | Strong global community focused on decentralization. | Satoshi Nakamoto, Bitcoin Core Developers |

| Ethereum | Active development community promoting smart contracts. | Vitalik Buterin, Ethereum Foundation |

| Solana | Rapidly growing ecosystem supporting DeFi and NFTs. | Anatoly Yakovenko, Solana Labs |

The contributions of these key individuals and communities are crucial for driving innovation and maintaining the networks’ integrity and functionality.

Regulatory Environment and Its Influence

The regulatory landscape surrounding Bitcoin, Ethereum, and Solana is ever-evolving and significantly impacts their market dynamics. Governments across the globe are working on frameworks to regulate cryptocurrencies, which can lead to immediate effects on price movements.Regulations can affect market access, trading volumes, and investor confidence. For example, announcements of stricter regulations in major markets often lead to initial price drops, while positive regulatory news may boost investor sentiment.

Additionally, regional differences in regulatory approaches can create disparities in how cryptocurrencies perform, especially in jurisdictions that embrace crypto innovation versus those that impose heavy restrictions.

Closure

As we wrap up our exploration of the bitcoin ethereum solana chart, it becomes clear that staying informed about their market behaviors and trends is crucial for any investor. By understanding the technical indicators, market sentiment, and potential future scenarios, traders can better navigate the complexities of the crypto landscape.

Commonly Asked Questions

What are the key differences between Bitcoin, Ethereum, and Solana?

Bitcoin is primarily a digital currency, Ethereum focuses on smart contracts and decentralized applications, while Solana is known for its high transaction speeds and lower costs.

How can I analyze the bitcoin ethereum solana chart effectively?

Utilizing technical indicators such as moving averages and RSI can help identify trends and make informed predictions based on the chart data.

What factors influence the prices of Bitcoin, Ethereum, and Solana?

Market sentiment, news events, regulatory changes, and community developments all play significant roles in price fluctuations.

How do I manage risks when trading these cryptocurrencies?

Implementing strategies like setting stop-loss orders and diversifying your portfolio can help mitigate risks associated with trading.

What role does community support play in cryptocurrency development?

Active communities contribute to the ongoing development and improvement of each cryptocurrency, fostering innovation and longevity.