Ethereum And Bitcoin Price Usd Market Insights And Trends

Ethereum and bitcoin price usd is at the forefront of cryptocurrency discussions, captivating both seasoned investors and newcomers alike. As two of the most prominent digital currencies, their journeys have been marked by innovation, market volatility, and community engagement. Understanding the intricate details surrounding their price movements and market behaviors can provide valuable insights for anyone interested in the evolving landscape of cryptocurrency investment.

This exploration delves into the historical context of Ethereum and Bitcoin, highlighting their foundational differences, market capitalization, and the significant price events that have shaped their paths. Moreover, we will examine the factors influencing their prices, offer expert predictions, and present an in-depth investment perspective, all aimed at illuminating the dynamic nature of these cryptocurrencies in the current market.

Overview of Ethereum and Bitcoin

The world of cryptocurrencies is largely dominated by two key players: Bitcoin and Ethereum. While both serve as digital currencies, they have fundamentally different purposes and technologies underpinning them. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was designed primarily as a digital alternative to traditional currency. In contrast, Ethereum, introduced in 2015 by a team led by Vitalik Buterin, is not just a currency but a platform for building decentralized applications (dApps) through smart contracts.Historically, Bitcoin was the first cryptocurrency and has established itself as a store of value, often referred to as “digital gold.” Ethereum, however, has carved a niche by enabling developers to create a wide array of applications and services, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

As of now, Bitcoin holds a substantial lead in market capitalization, typically hovering around 40-50% of the total cryptocurrency market, while Ethereum trails but has shown exponential growth.

Price Trends in USD

Examining the price trends of Bitcoin and Ethereum over the years reveals fascinating insights into their respective market dynamics. Bitcoin’s price has seen dramatic surges and corrections, particularly notable in 2017 when it skyrocketed to nearly $20,000 before crashing. Ethereum has also experienced volatility, with a significant price increase in 2021 that saw it reach over $4,000.Below is a table summarizing key price fluctuations of both cryptocurrencies over the last year:

| Month | Bitcoin Price (USD) | Ethereum Price (USD) |

|---|---|---|

| January 2023 | $16,500 | $1,200 |

| April 2023 | $30,000 | $2,000 |

| July 2023 | $25,000 | $1,700 |

| October 2023 | $28,000 | $1,900 |

Factors Influencing Prices

The price movements of both Bitcoin and Ethereum are influenced by a multitude of factors. Key considerations include market sentiment, which can be swayed by news events, social media trends, and macroeconomic indicators. When the market is bullish, prices tend to surge, while a bearish sentiment typically leads to declines. Additionally, regulatory developments play a significant role in shaping the landscape for both cryptocurrencies.

For instance, announcements regarding government regulations can either bolster investor confidence or instill fear, affecting price significantly. Technological advancements, especially concerning Ethereum’s ongoing upgrades (such as the transition to Ethereum 2.0), also impact its valuation, making it a closely watched variable for investors.

Price Predictions

Forecasting the future price of cryptocurrencies like Bitcoin and Ethereum can be challenging, given their inherent volatility. Analysts often use a combination of technical analysis, historical price patterns, and market sentiment indicators to make educated predictions. Expert opinions vary widely; some analysts predict Bitcoin will eventually reach $100,000, while others believe it may stabilize around current levels. Ethereum’s future is equally debated, with some forecasting prices could soar past $10,000 as adoption increases and the ecosystem expands.The following table compares various predictive models and their projected outcomes for Bitcoin and Ethereum:

| Model | Bitcoin Prediction (USD) | Ethereum Prediction (USD) |

|---|---|---|

| Technical Analysis | $70,000 | $5,000 |

| Market Sentiment | $90,000 | $8,500 |

| Blockchain Adoption Growth | $100,000 | $10,000 |

Investment Perspectives

Investing in cryptocurrencies comes with both opportunities and risks. Bitcoin is often viewed as a safer asset for long-term investment, while Ethereum appeals to those interested in capitalizing on the burgeoning dApp ecosystem. However, both assets are subject to high volatility, which can pose risks for investors.When considering investment strategies, it is essential to understand the following key points:

- Volatility: Prices can fluctuate dramatically in short periods.

- Diversification: Investing in both cryptocurrencies may spread risk.

- Long-term vs. Short-term: Identify your investment horizon.

- Security: Use reputable wallets and exchanges to safeguard assets.

- Regulatory Environment: Stay informed about changes in cryptocurrency laws.

Market Comparison

A comparative analysis of Ethereum and Bitcoin reveals interesting insights into their respective trading behaviors. Over the past year, Bitcoin has consistently commanded higher trading volumes, but Ethereum has gained traction with increasing liquidity as it powers various DeFi protocols.The following table showcases the trading platforms with the highest volume for both cryptocurrencies:

| Platform | Bitcoin Volume (USD) | Ethereum Volume (USD) |

|---|---|---|

| Exchange A | $3 Billion | $500 Million |

| Exchange B | $1.5 Billion | $700 Million |

| Exchange C | $2 Billion | $1 Billion |

Community and Ecosystem Impact

The community plays a pivotal role in both Bitcoin and Ethereum, significantly influencing their values and developments. Bitcoin’s community is often characterized by a strong focus on preservation of its original vision as a decentralized currency. Conversely, Ethereum’s community is robustly engaged in pushing technological innovations, such as the numerous upgrades and developments that enhance its functionality.Ecosystem improvements, such as Ethereum’s shift to a proof-of-stake model, can lead to increased investor confidence and subsequent price appreciation.

User testimonials often reflect a strong sense of community support for both currencies, with many citing the collaborative nature of development and shared visions for the future of decentralized finance.

Conclusive Thoughts

In conclusion, the current trends in ethereum and bitcoin price usd reflect a complex interplay of historical events, market sentiment, and external influences. As developments continue to unfold in the cryptocurrency realm, both investors and enthusiasts should stay informed about potential shifts that could impact future pricing. By understanding the foundational aspects and market dynamics of these digital currencies, one can make more informed decisions in this rapidly changing financial landscape.

FAQ Summary

What is the current price of Ethereum and Bitcoin in USD?

The current prices fluctuate frequently; it’s best to check a reliable financial news source or cryptocurrency exchange for real-time updates.

What factors can cause fluctuations in the price of Ethereum and Bitcoin?

Prices can be influenced by market sentiment, regulatory news, technological advancements, and broader economic conditions.

Are Ethereum and Bitcoin used for the same purposes?

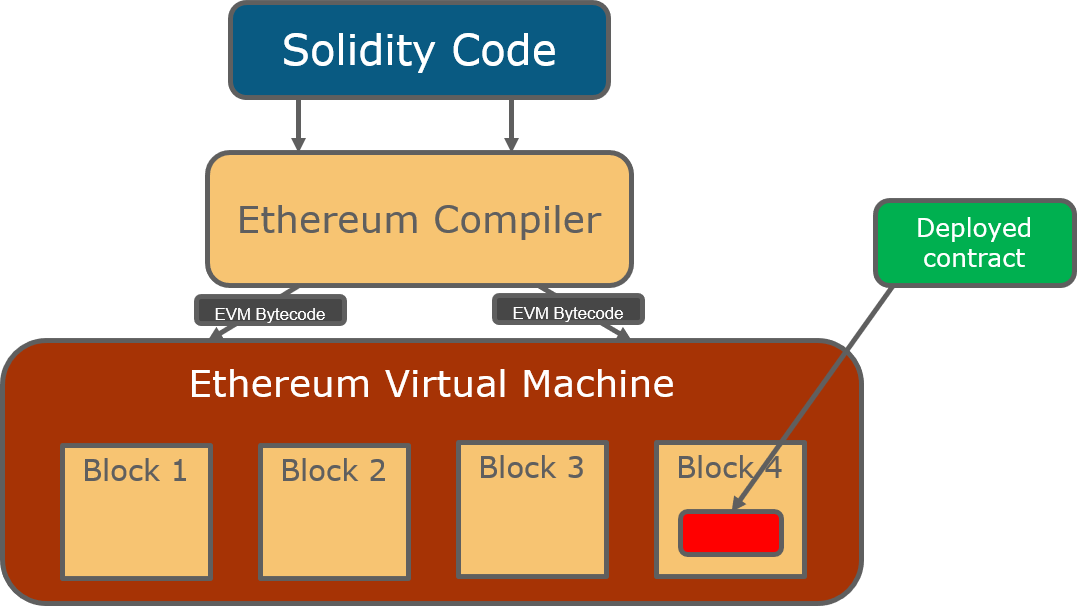

While both are cryptocurrencies, Bitcoin primarily serves as a digital currency, whereas Ethereum is designed for decentralized applications and smart contracts.

How can I invest in Ethereum and Bitcoin?

You can invest through cryptocurrency exchanges, using fiat currency to purchase directly or through trading platforms for existing cryptocurrencies.

What are the risks associated with investing in Ethereum and Bitcoin?

Investing in cryptocurrencies carries risks like market volatility, regulatory changes, and potential cybersecurity threats; thorough research is essential.