Bitcoin And Ethereum Are Leading Crypto Giants

Kicking off with bitcoin and ethereum are two of the most recognized cryptocurrencies in today’s digital economy, each representing unique concepts and applications that have transformed financial landscapes. While Bitcoin was created to be a decentralized digital currency, Ethereum has evolved into a robust platform for smart contracts and decentralized applications. Together, they illustrate the diverse possibilities within blockchain technology.

Understanding the foundational concepts behind Bitcoin and Ethereum opens the door to exploring their historical context, technological differences, and economic models. With Bitcoin’s finite supply and Ethereum’s flexibility for innovation, both cryptocurrencies play distinct roles in the digital economy. Their growth and development have sparked a wave of interest and investment in the world of decentralized finance.

Overview of Bitcoin and Ethereum

Bitcoin and Ethereum are two of the most prominent cryptocurrencies that have revolutionized the financial landscape. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency and introduced the concept of decentralized digital currency. Ethereum, launched in 2015 by Vitalik Buterin and others, expanded on this concept by providing a platform for decentralized applications through smart contracts.

Bitcoin primarily serves as a digital currency aimed at facilitating peer-to-peer transactions, whereas Ethereum functions as a versatile platform that enables developers to build decentralized applications (dApps) using its blockchain technology. Notably, while Bitcoin has a capped supply of 21 million coins, Ethereum does not have a fixed limit, which influences their economic models and long-term value.

Use Cases and Applications

Both Bitcoin and Ethereum have unique applications in the real world that showcase their utility and potential. Bitcoin is often referred to as “digital gold,” primarily used for online transactions and as a store of value. In contrast, Ethereum’s capability to execute smart contracts makes it a foundational technology for a wide array of applications, from finance (DeFi) to supply chain management.Some notable real-world applications include:

- Bitcoin ATMs, which allow users to buy and sell Bitcoin for cash.

- Ethereum-based decentralized finance (DeFi) platforms like Uniswap and Aave, enabling users to lend and borrow assets without intermediaries.

- Non-fungible tokens (NFTs) that are built on the Ethereum blockchain, enabling ownership and trade of unique digital assets.

The contrast between Bitcoin as a currency and Ethereum as a platform is evident in their respective use cases. Bitcoin focuses primarily on financial transactions, while Ethereum’s flexibility allows for diverse applications through its smart contract functionality.

Economic Models and Value Proposition

The economic models of Bitcoin and Ethereum are fundamentally different, impacting their value propositions. Bitcoin’s supply is limited to 21 million coins, which creates scarcity and potential for appreciation over time. Its inflation rate decreases through a process known as halving, which occurs approximately every four years.Ethereum, on the other hand, has a more dynamic supply model without a specific cap.

This flexibility allows for ongoing development and scaling, but also introduces inflation as new Ether is minted to incentivize network participants.

| Year | Bitcoin Market Cap | Ethereum Market Cap |

|---|---|---|

| 2018 | $69 billion | $13 billion |

| 2019 | $130 billion | $25 billion |

| 2020 | $130 billion | $67 billion |

| 2021 | $1 trillion | $300 billion |

| 2022 | $400 billion | $100 billion |

Decentralization enhances the value proposition of both cryptocurrencies, as it reduces the risk of central authority control. This feature is appealing to users who value privacy and autonomy in their financial dealings.

Technological Differences

Bitcoin and Ethereum utilize different consensus mechanisms which significantly impact their performance. Bitcoin operates on a Proof-of-Work (PoW) model, requiring miners to solve complex mathematical problems to validate transactions. In contrast, Ethereum is transitioning to a Proof-of-Stake (PoS) model, which allows users to validate transactions based on the amount of Ether they hold and are willing to ‘stake’ as collateral.Transaction speeds also differ greatly between the two networks.

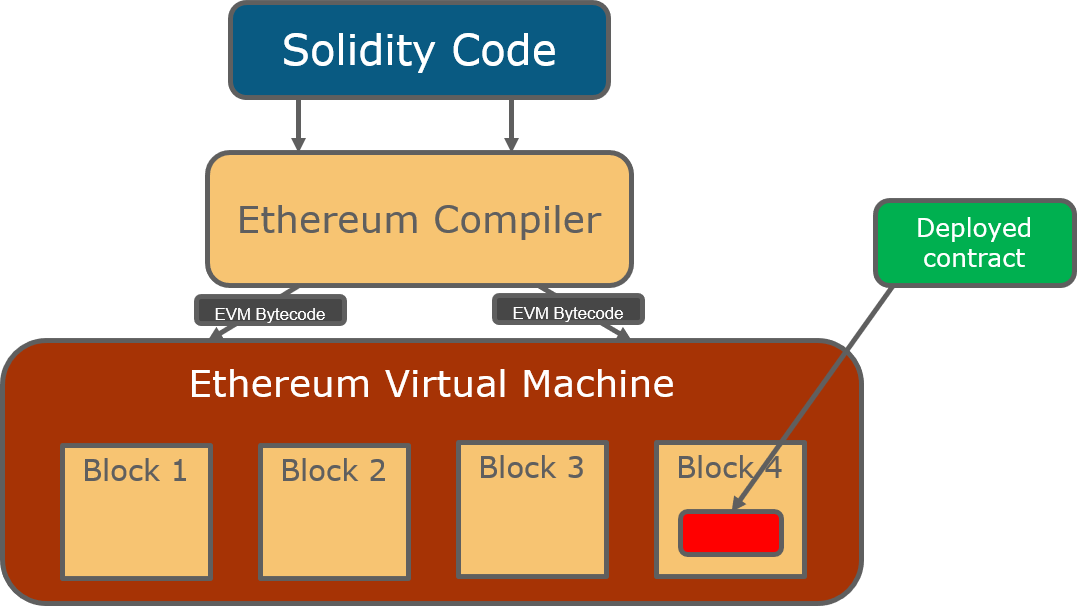

Bitcoin transactions can take around 10 minutes to confirm, while Ethereum transactions are typically confirmed in seconds, making it more suitable for applications requiring fast interactions.The programming languages used for development further highlight their differences. Bitcoin primarily uses C++ for its core protocol, while Ethereum utilizes Solidity, a language specifically designed for writing smart contracts, enabling a broader scope of programming capabilities.

Community and Governance

The communities behind Bitcoin and Ethereum play a crucial role in their development and governance. Bitcoin’s community is driven by a commitment to maintaining its status as a decentralized currency, with various forums and discussion platforms for users to engage in.Ethereum’s community, on the other hand, is more diverse and active in proposing changes through Ethereum Improvement Proposals (EIPs). Governance in Ethereum is more fluid, allowing for rapid advancements and updates, while Bitcoin’s governance tends to be more conservative, prioritizing stability and security.Community proposals significantly shape the future of both ecosystems, with developers and users alike contributing ideas and solutions to enhance their respective platforms.

Security and Risks

Both Bitcoin and Ethereum have robust security features but are not immune to risks. Bitcoin relies on its extensive network of miners and cryptographic principles to secure transactions, while Ethereum’s smart contracts require rigorous coding to prevent vulnerabilities.Potential risks include market volatility, regulatory scrutiny, and technological flaws. Notable hacks or security breaches in the history of these cryptocurrencies include:

- The 2016 DAO hack, which affected Ethereum and resulted in a significant loss of funds.

- Bitcoin’s Mt. Gox exchange hack, leading to the loss of 850,000 BTC in 2014.

- Various vulnerabilities in smart contracts that have led to significant financial losses.

Future Trends and Predictions

Emerging trends within the Bitcoin and Ethereum ecosystems indicate a shift towards increased adoption and innovative applications. Bitcoin is likely to see more institutional investment and integration into traditional finance, while Ethereum’s role in DeFi and NFT marketplaces is expected to grow substantially.However, both cryptocurrencies face potential regulatory challenges that may impact their operations. Increased scrutiny from governments worldwide could lead to changes in how they are viewed and utilized in the financial system.A forecast table illustrating possible future market scenarios for both cryptocurrencies is as follows:

| Year | Bitcoin Price Prediction | Ethereum Price Prediction |

|---|---|---|

| 2023 | $30,000 | $2,500 |

| 2024 | $50,000 | $4,000 |

| 2025 | $100,000 | $10,000 |

These trends suggest that both Bitcoin and Ethereum will continue to evolve, presenting new opportunities and challenges for investors and users alike.

Concluding Remarks

In conclusion, bitcoin and ethereum are not just currencies; they are catalysts for innovation in the financial sector. Their differing use cases and technologies highlight the potential for future developments in blockchain. As we look to the future, monitoring trends and regulatory challenges will be crucial for understanding how these two giants will continue to shape the landscape of digital finance.

FAQ Summary

What is the primary purpose of Bitcoin?

The primary purpose of Bitcoin is to serve as a decentralized digital currency that enables peer-to-peer transactions without the need for intermediaries.

How does Ethereum differ from Bitcoin?

Ethereum differs from Bitcoin in that it is more than just a digital currency; it is a platform that allows developers to build decentralized applications using smart contracts.

What are smart contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, which automatically enforce and execute actions on the Ethereum blockchain.

Is investing in Bitcoin and Ethereum risky?

Yes, investing in Bitcoin and Ethereum carries risks, including market volatility, regulatory changes, and security vulnerabilities, which potential investors should carefully consider.

What are the transaction speeds for Bitcoin and Ethereum?

Bitcoin transactions typically take around 10 minutes for confirmation, while Ethereum transactions can be confirmed in about 15 seconds, reflecting their different technological frameworks.